After the news came out for ServiceTitan, I thought that I’d run a quick analysis on the company and where I believe the company should trade in the public markets. This article will pull from the fictional “Project Titan” book and model that I created. I will drop the pages from the book alongside my commentary.

Executive Summary

ServiceTitan, a vertical SaaS provider for the trades, filed their S-1 on November 18, 2024. In the November 2022 Series H, ServiceTitan accepted a compounding IPO ratchet structure. In short, this means that the company is on the clock to go public to minimize dilution impact should they trade below the hurdle price

Based on our analysis, which we cross checked with other investors, we believe that the company will begin trading below the hurdle price. Recent news support this analysis as the company aims for a valuation of up to $5.95B (a bump from their initial valuation of $5.2B earlier this month), down from their $7.6B valuation in 2021

Our analysis imputes a $6.4B valuation. We ran a “Rule of” regression, imputing a 7.8x EV/NTM Revenue multiple. We assumed a 20% NTM Revenue Growth and 5% NTM EBITDA

Company Overview

In short, ServiceTitan is an end-to-end SaaS platform tailored to home and commercial service professionals — plumbers, electricians, and HVAC specialists. They’re an operating system for these service professionals, helping them run their business.

The company has seen a series of down rounds since their peak valuation in 2021.

Choosing the Right Comps

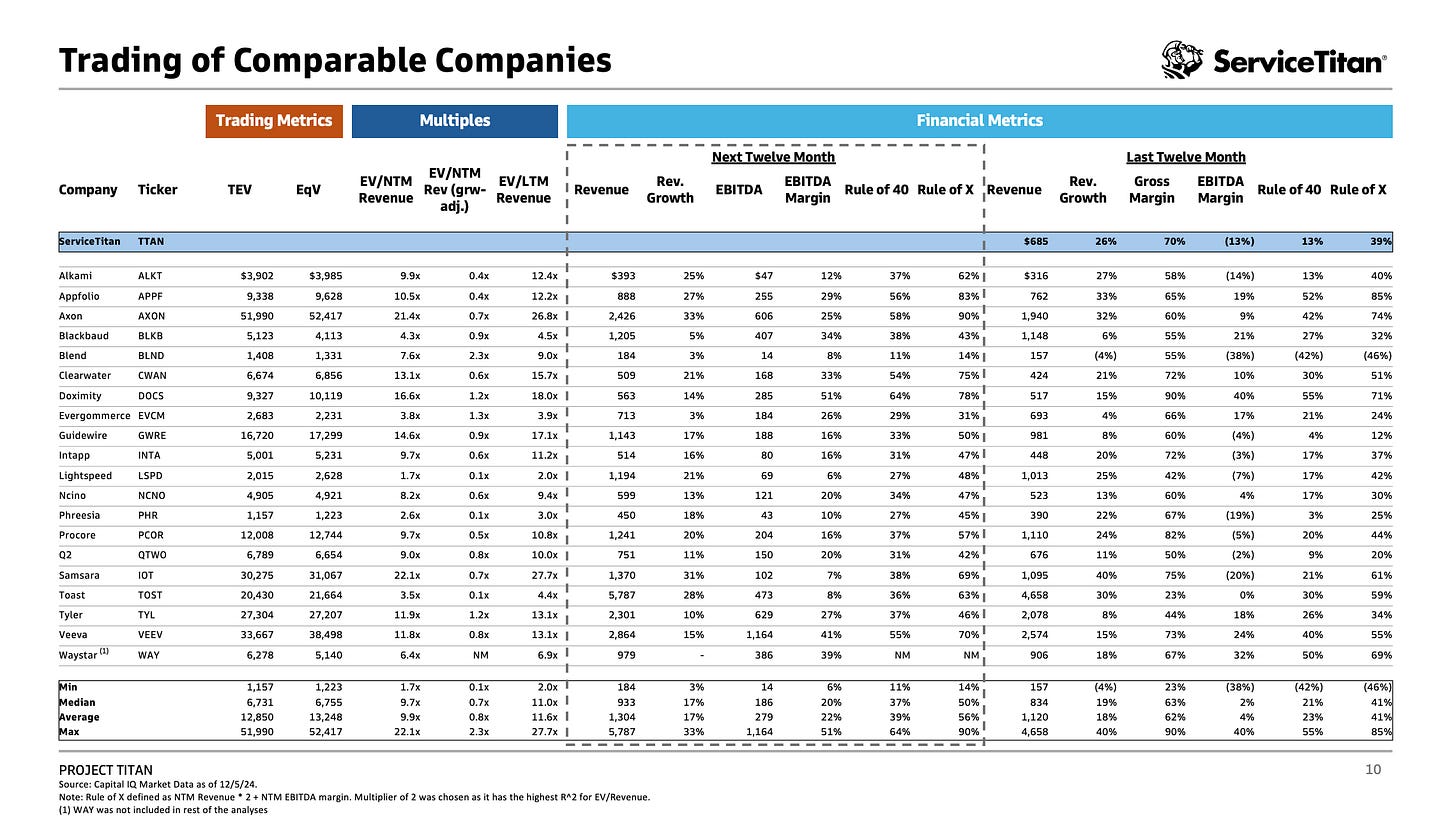

We used the Vertical SaaS (VSaaS) comps that Meritech provided as reference, and narrowed our direct peers to VSaaS with an enterprise value between $4 - $9B. We believe this is the best range given their historical valuations charted above.

We believe looking at VSaaS peers was the most comparable given the nature of their business model. VSaaS tend to trade at a premium compared to other SaaS businesses given its mission criticality, and as such, it made more sense to view ServiceTitan as one of these VSaaS business. Unfortunately, due the limited number of home services businesses in the public markets, we decided to narrow down our VSaaS comp list strictly based on their TEV.

How ServiceTitan Stacks Up

ServiceTitan saw 26% LTM revenue growth, which is higher than the peer average of 18%. This isn’t surprising given that they’re 1) smaller than most of their peers - and if you’re smaller, you have to grow faster, and 2) they’re also cash flow negative and as a result, they must be prioritizing growth.

Valuation

I ran a simple regression to value this company, using only the direct peers, but also left in the all VSaaS for reference. My valuation imputes a $6.4B total enterprise value.

For this “Rule of”, I used: (NTM revenue growth * 2) + NTM EBITDA margin.

I decided to use NTM because virtually all SaaS companies are valued on a multiple of their forward metrics

I decided to use 2 as the multiplier because this returned the highest R^2. I also don’t believe these VSaaS companies are big/mature enough for me to use 3 (with the exception of companies like Toast)

As for the assumptions, I assumed a 20% NTM revenue growth rate and a 5% NTM EBITDA margin. Both of these are conservative estimates based on how the company is currently trending. With these assumptions, the regression returns at 7.8x EV/NTM Revenue multiple, which means the company will trade below their other VSaaS peers. I’ll speak to this later on in the comps analysis.

I’ve sensitized the revenue growth and the NTM revenue multiple, and I believe that $5.9B - $7.4B is a reasonable valuation for the company. Sell-side is valuing the company at $5.95B (as of 12/10/2024), imputing a ~6.9-7.5x EV/NTM Revenue multiple (depending on growth rate). I don’t believe this is completely unreasonable, I think they’re going to price the stock conservatively to ensure a pop when the company starts trading.

Trading of Comparable Companies

Per the assumption listed the above, the company will trade below their peers. To their direct peer group (n=5) and all VSaaS (n=20), the company will trade at a 21% and 11% discount from an EV/NTM Revenue basis, respectively. After adjusting for growth in their EV/NTM Revenue (growth adjusted), the company will trade at a 48% and 46% discount to its direct peers and all VSaaS, respectively.

Here’s a snip of how the company stacks to their other VSaaS peers.

Conclusion

Overall, I think sell-side is pricing this company quite conservatively. Like I said before, I believe sell-side wants to ensure a pop in the stock price upon listing. However, there are couple fundamentals in the business that should raise eyebrows for investors. For example, ServiceTitan’s unit economics doesn’t look the best relative to the average public SaaS company.

Regardless, it’ll be interesting to see how investors respond to this during its road show. I’m also keen to see how sell-side markets this company to public investors. I’ll be keeping tabs on ServiceTitan, and will update this / or write another piece if it makes sense to.

Special thanks to

for helping me with this.