Reviving Software: Opening the Tech Innovation Window

Executive Summary

SaaS companies are trading lower due to deteriorating fundamentals as they reach the maturity stage on the SaaS S-curve

Tech IPO market has halted because of a disconnect between valuations during Covid and today

Generative AI will re-open the innovation window, and more broadly, the tech market

Where’s SaaS

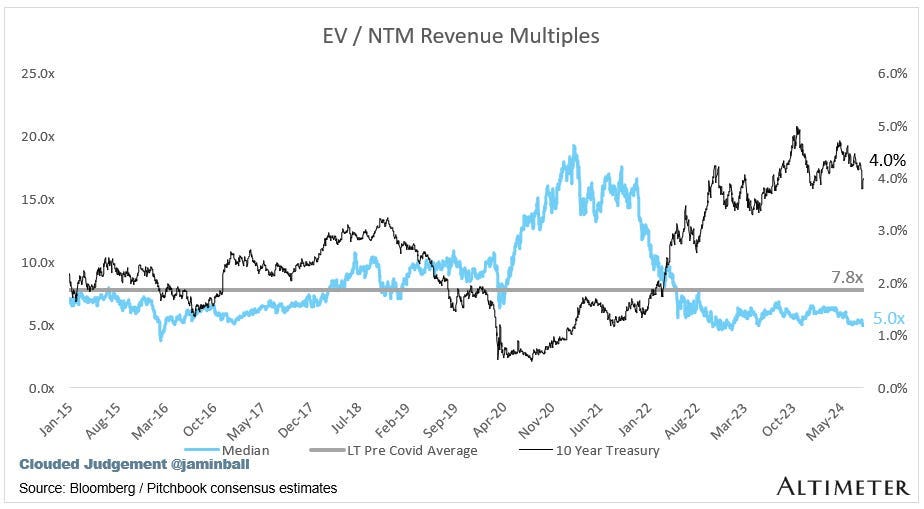

The tech boom days are over. SaaS businesses are generally valued on a multiple of their NTM revenue; they are currently trading at a medium of 5.0x revenue, a significant drop from the pre-Covid long-term average of 7.8x. Gone are the days when SaaS companies traded at a 20.0x multiple, but the big question is, will the market recover?

This multiple compression has stalled the tech IPO market, with only two major tech IPOs since 2021 (Klaviyo in 2023 and Rubrik in 2024). Not to mention, share prices are down ~7% and ~16% since their respective IPOs. So… why?

Why are SaaS valuations suffering? Why are share prices tanking?

SaaS companies are suffering due to deteriorating fundamentals, i.e., these businesses are not performing as well as they did during Covid. The simple explanation is that we’ve passed the center of the SaaS S-curve; as a result, incremental revenue will become harder to come by.

SaaS companies have responded by spending more on S&M, hiring more employees, etc. You would expect Net Dollar Retention (NDR) to increase, but it has been declining since 2022 and has yet to stabilize. For many SaaS companies, we’ve seen a decline in revenue growth and sales efficiency — suggesting that companies are struggling to adapt, and they’re punished for it in the public markets.

Lesson #1: If revenue growth is slowing and your margins aren’t getting any better, then you’re in trouble.

Is this a macro problem? Or is this the new norm? I say the new norm.

Where do we go from here?

Despite these challenges, investors should remain optimistic as we look to the future. My view is that the SaaS industry is on the cusp of a major inflection point, driven by the rise of Generative AI (Gen AI). Let’s look at the S-curve:

Simply put, we’re in an innovation window. I believe that Gen AI represents the third major tech cycle in the past 50 years and it began with ChatGPT.

The first major tech cycle began with the PC when Intel introduced the microprocessor in 1971, enabling the production of the first personal computers. The second major tech cycle began with the web browser/internet in 1994, democratizing access to information. The third major tech cycle with Gen AI will be a paradigm shift in corporate efficiency and productivity.

Why I believe Gen AI will reopen the tech market:

ChatGPT reached 100mm users in 2 months, outpacing TikTok (9 months), Facebook (4.5 years), and LinkedIn (7.9 years)

According to Crunchbase, 50% of YC’s Winter ‘24 batch is built with AI

96% of Wall Street covered-companies have articulated an AI strategy

AI capex could reach $1tn+ over the next several years

Amazon will spend $100bn+ on data center capex over the next decade, representing 53% of total capex

OpenAI spent ~$700k/day operating ChatGPT in 2023

The Anthology Fund, a $100mm initiative created by Menlo Ventures and Anthrophic to fuel the next generation of AI startups

Consumer consumption and business investment in the Gen AI space will open this innovation window, allowing us to see growth similar to what we experienced in previous years.

How should companies respond? My view is that Gen AI will create investor confidence and reopen the tech IPO market; however, companies must act, or they’ll be left in the dust.

Why? Because Gen AI will improve corporate efficiency, boosting S&P operating margins by 200 bps ($55bn) over the next 5 years. However, I believe the real opportunity lies in leveraging AI for revenue enhancements and new revenue streams.

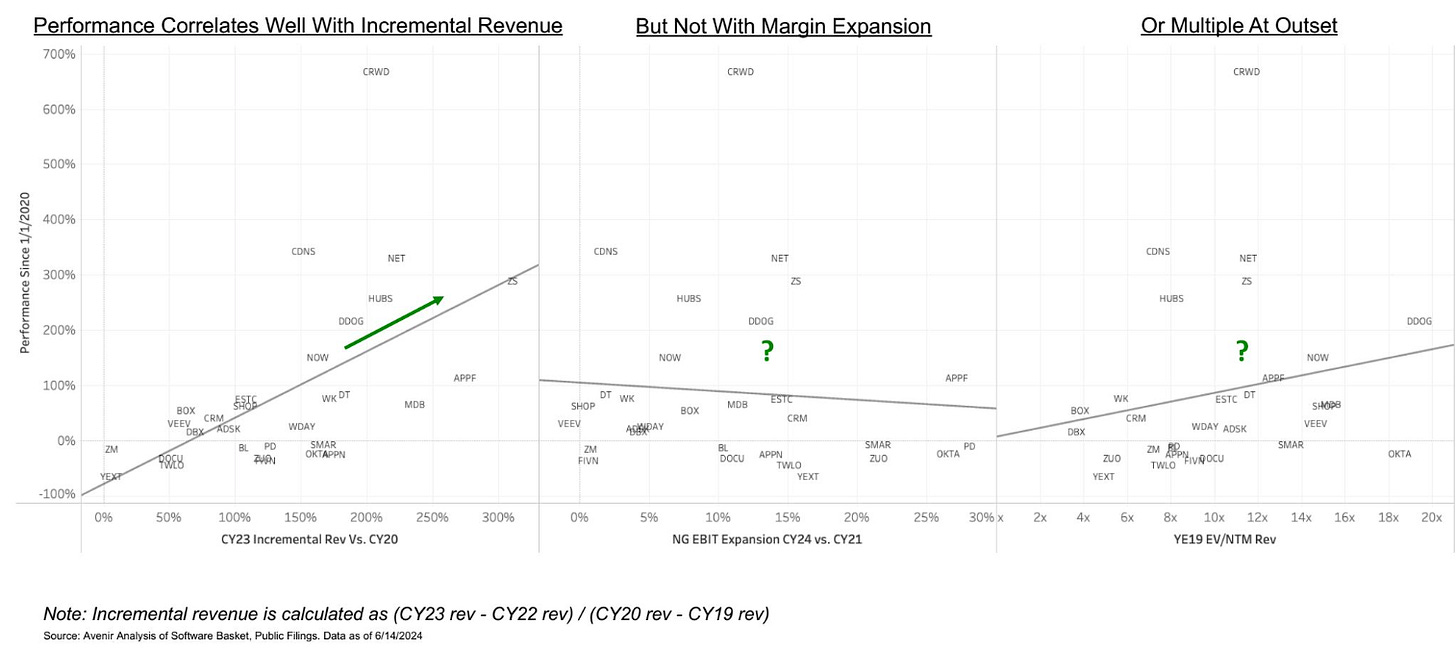

32% of companies have articulated a strategy to use AI for revenue enhancements, and 12% for new revenue streams. Yes, improving margins is beneficial. However, we see performance correlating more closely with incremental revenue than with margin expansion.

Lesson #2: If you’re a company with slowing revenue growth, can you offer AI products to boost growth?

Why is this not priced in?

The simple answer is that investors overestimate the magnitude of disruption in the near term and underestimate it in the long term. There’s still a lot of room for growth in AI. ChatGPT still makes mistakes with simple math problems, Bard flopped, and I still can’t use AI to write this piece.

But let’s step back from the near-term and look to the future. We’re still in the early stages of AI developments, with chatbots representing Level 1 of a broader AI landscape that could eventually include advanced reasoners, agents, innovators, etc.

My parents are in the restaurant business, and a reduction of one full-time employee could reduce labor costs by 8%. Investors care too deeply about the short term, and we’re not seeing the full transformative effects of AI… yet.

It’s also not priced in because of recessionary fears.

So, what happens if there is a recession?

To answer directly: A recession will likely boost company efficiency but slow revenue growth. Let’s dive deeper into this idea.

The Nasdaq is down from its all-time highs; Warren Buffett has sold approximately 55.8% of his Apple position since the start of the year; the VIX has hit its highest level since the global pandemic. There's no shortage of talk about a potential recession, but what does that mean for the broader tech market?

During recessionary times, companies tend to become more efficient. Certainly, there’s fat for tech companies to keep trimming (as mentioned earlier: reduce headcount, lower S&M spend, etc).

However, improving efficiency doesn’t directly translate to better valuations. Revenue remains the key driver of software valuations, and unfortunately, a recession will likely dampen revenue growth.

Software is basically screwed if there’s a recession, and we’ll likely see a wider disparity between the top software companies and everyone else.

But history has shown us that after every downturn, there’s always a rebound. The Renaissance followed the Dark Ages, and I believe a "Software Renaissance" is on the horizon.