Growth Adjusted Rule of 40

If you're using revenue growth or the rule of 40 to value your company, then you're doing it ALL wrong

I looked at over 150+ public companies and found that it’s no longer revenue growth or the rule of 40 that is the primary driver of valuation. In this short piece, I’ll go over the growth adjusted rule of 40 and a quick market update.

Growth-Adjusted Rule of 40

Revenue growth and the rule of 40 is no longer the primary driver for valuations - the growth adjusted rule of 40 is. Before I explain what this is, see below.

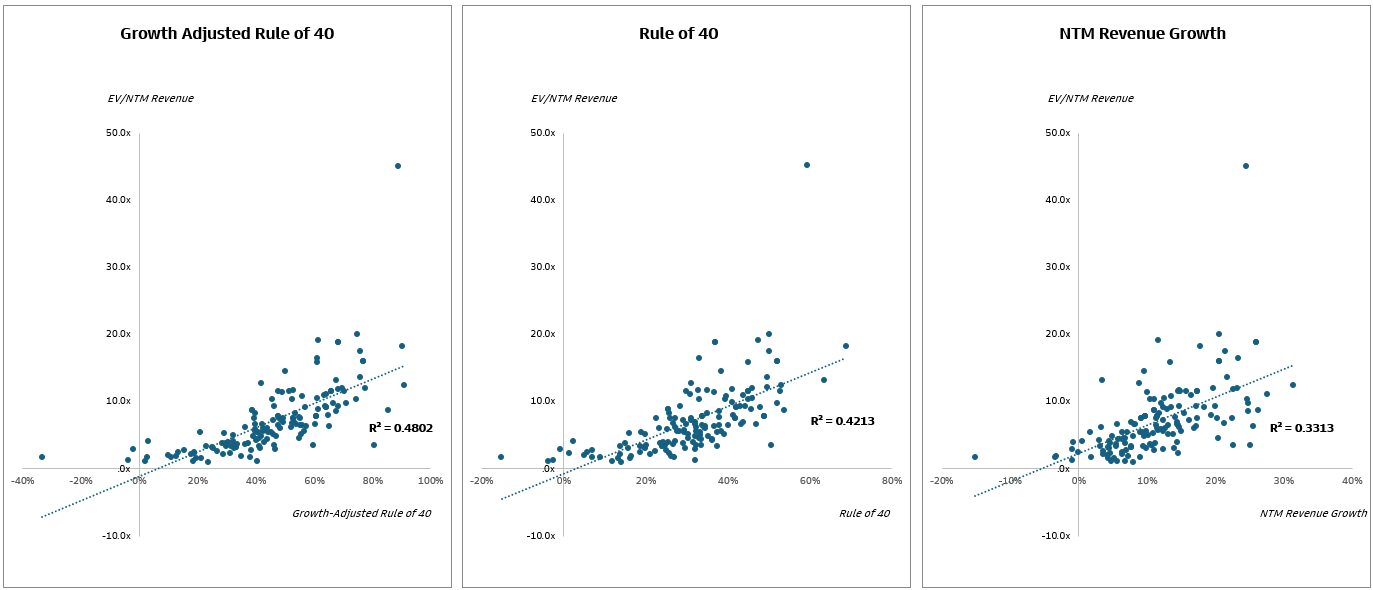

From the above, we can see that the growth-adjusted rule of 40 have a R^2 of 0.48, while the rule of 40 has a R^2 of 0.42, revenue growth has a R^2 of 0.33. I did this using an n=150, and corroborated the data with multiple other investment banks and other investing shops.

What exactly is the growth-adjusted rule of 40? Before diving in, we must first understand what the rule of 40 is. The rule of 40 is a valuation metric, where we add revenue growth and profitability (often times FCF margin). The growth-adjusted rule of 40 is where you add a certain multiplier to revenue-growth.

We do this because in software, investors often reward growth over profitability. After messing around in the Excel sheet, I found that the highest R^2 had a revenue multiplier of 2.1. This means that growth is valued 2.1x more than profitability.

Why does this matter?

A few reasons!

If you’re a public company, you should prioritize generating revenue growth than becoming more profitable

This can be helpful when valuing a company / pricing a company. Take the company revenue growth multiple it by 2.1 and add your FCF margin to find your growth-adjusted rule of 40. Then, plug this number into the equation to find your implied multiple.

Market Update (as of 1/18/2025)

Here are relative software revenue multiples. Apologies - my computer isn’t powerful enough to pull individual dates, so ended up pulling every quarter (lol) for the last 10 years.

Key Takeaways:

Multiples have came down significantly post-ZIRP period, but have leveled out to pre-pandemic norms

Vertical software leads the pack with the highest valuation, with data and infra lagging in second

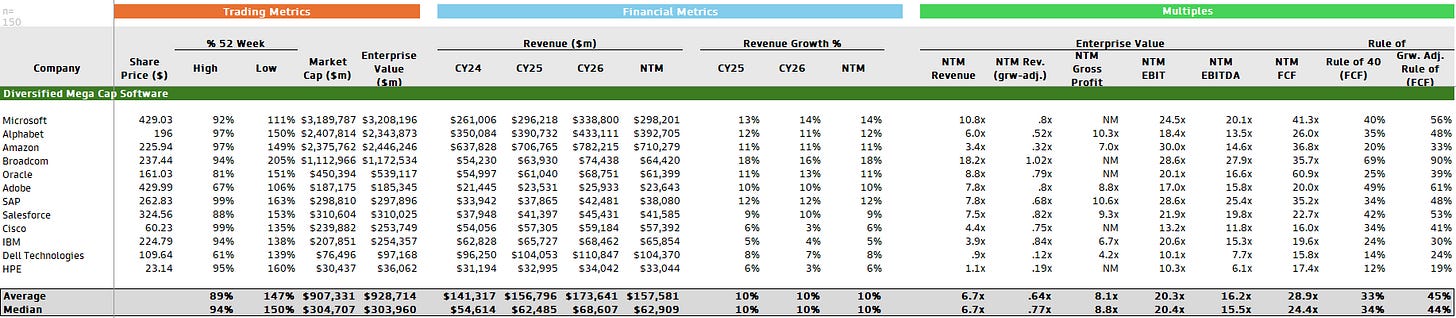

Here are the software trading comparables by indices! I had more financial metrics, but due to constraints, I’ll only show trading metrics, revenue/growth, and valuation multiples.